Can Dynamic Discounting for Enterprise Businesses Improve Cash Flow?

Most AP departments have heard of “early pay discounts,” but in manual or partially automated departments, lengthy invoice processing times keep them from becoming a reality. However, with the proper enterprise solution, electronic invoices are processed more efficiently and early approvals are the norm–making dynamic discounting available to AP departments. With dynamic discounting for enterprise businesses, suppliers are paid early in return for accepting a discounted rate. The discount is determined precisely by an algorithm in relation to exactly what day accounts payable chooses to pay their supplier.

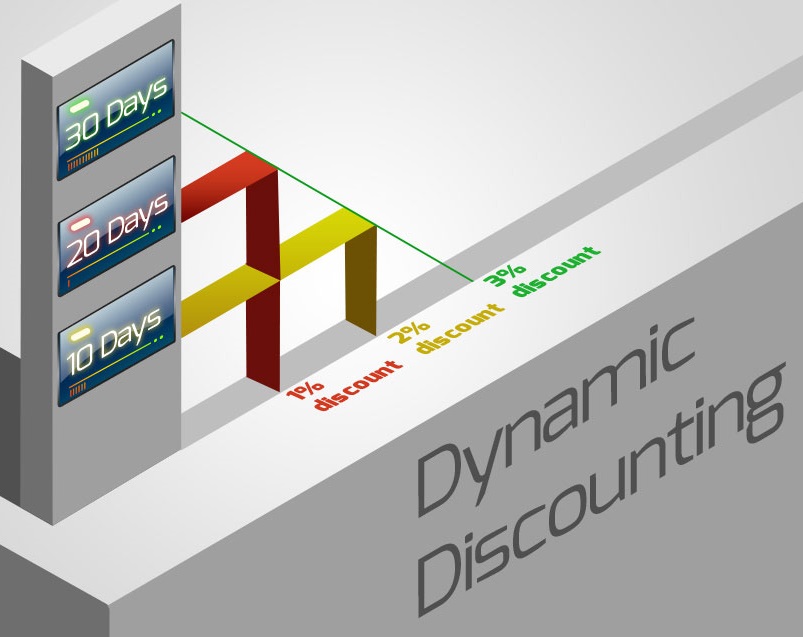

Generally, suppliers will offer customers a specific percentage off of their invoice for paying prior to the due date. For example, a supplier might take two percent off of the invoice if the customer pays in full within ten days rather than waiting the full 30 days. On the other hand, customers don’t receive any discount at all should they decide to wait until after the ten days to pay. They may still be paying on time, but during the 11 to 30 days time period. The obvious advantage of dynamic discounting for enterprise is that AP pays less and suppliers receive payment quicker, enabling better cash flow.

A JetBlue case study shows how the iPayables enterprise solution helps offer dynamic discounting to specific suppliers. When their suppliers make the decision in favor of choosing the early payment option, the system generates a discount credit that is automatically applied via their special coding and the discount is reflected in the actual invoice.

The only way to successfully implement dynamic discounting is in accordance with an enterprise-level AP automation solution that employs e-invoicing. With a manual or partially automated department, trying to take advantage of dynamic discounting would require manually routing invoices to be signed, as well as manually matching the purchase orders. There would be way too much time-intensive work involved that would change it from cost-effective to cost-prohibitive.

According to the previously mentioned Jet-Blue case study, by the time paper invoices have been entered into a company’s payables system, approximately 50% of them are already past due. Only 35% will have been entered by the 24th day. But with enterprise-level AP automation solutions, the time for invoice approval can be cut down to less than 3 days.

For a supplier aiming to manage and grow their business, receiving invoice payments within 10 days rather than 30 days is a huge improvement in cash flow. From their perspective, that increase in cash flow is likely worth offering a discount. Cash flow is the name of the game, and improving it is in any company’s best interest. Dynamic discounting for enterprise businesses also helps AP promote their own company’s growth by saving extra money, so they may suggest dynamic discounting to their suppliers for a mutually beneficial agreement. With dynamic discounting being a win-win for both customer and supplier, what more could a highly efficient accounts payable department ask for?